VAALCO Energy Inc. - Value in the Energy Sector

Over the span of an investing career, many mistakes are made. Some are due to a lack of research, some to a lack of conviction, and others to a lack of patience. The latter is a tale that I will weave as we work through this week’s value selection from The Profit Investigator.

As always, let’s begin with the overview of this lovely little stock.

Market Cap ~ $550M

Dividend ~ 4.8%

Institutional Ownership < 35%

Forward P/E ~ 2.8

If those four metrics don’t get you going then please check your pulse, look in the mirror to make sure that you still see a reflection, and then head on over to your local convenience store and get a nine-volt battery to stick on your tongue.

The company we are speaking of is VAALCO Energy, Inc. (EGY).

If you haven’t heard of VAALCO then you can rest assured that you are in the majority of investors, even those that don’t support the narrative that the energy sector is a bad long-term investment. VAALCO is a small, under-the-radar player in the industry, but one that more people should pay attention to. With that being said, let’s check them out!

Company Description

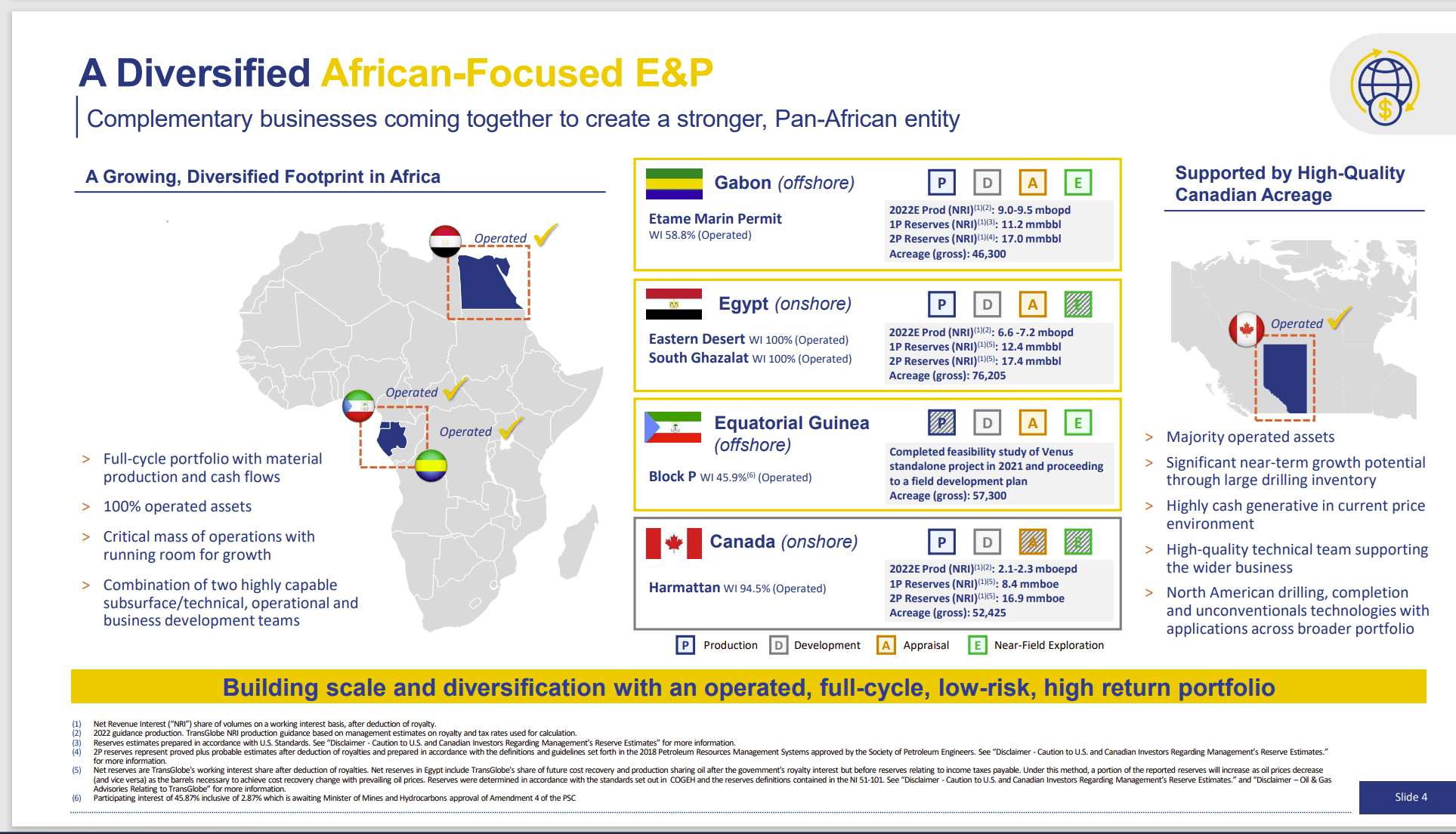

To explain the company simply; they acquire, explore for, develops, and produces crude oil and natural gas. Pretty straightforward forward right? The only thing that really makes them different than those that you know about is that instead of being a US company (technically they are based in TX) that does the majority of their work in the Permian Basin, VAALCO works in the Republic of Gabon in West Africa. They also own an undeveloped block offshore in Equatorial Guinea, West Africa. If you aren’t familiar with these places then you can join your second club in this article. That being said, the recent combination with TransGlobe energy also moves the combined company into other parts of Africa and even into Canada. (more on this later).

Now that we have the basic information, let’s move on to the fun stuff.

PROS

The Balance Sheet. There is nothing that gets in the way of investor returns like debt. The good thing for VAALCO investors is that they have zero to pay off. Yes, you read that right, ZERO. This is one of the few energy companies that you can find with long-term debt that lets you sleep well at night no matter the market conditions. The lack of debt is one thing, but when a company combines this with cash & equivalents equal to 10% of their current market cap then color me intrigued. Management has continued to do a tremendous job with this company and it can be seen in their balance sheet.

Oil Prices. While prices soaring to the $120 range may not be in sight currently, the range-bound pricing of oil is significant enough to allow companies to continue printing cash. But what about renewables? Well, say what you will about renewable energy sources and the EV movement, but oil isn’t going anywhere anytime soon. While many are projecting an increase in alternative sources, what many aren’t accounting for is the fact that even the EOA and EIA are calling for vastly different energy needs than what many are hearing from the mainstream media. The chart above highlights the simple ratio of EVs to other cars by 2040 and helps to show that even in that industry oil isn't going anywhere.

Dividend Hike. Paying back investors is one of the main reasons that many begin to dive into the energy sector in the first place. High yields and buybacks abound and entice those that want to add more passive income to their portfolios. VAALCO isn’t one of the massive yielders like some MLPs out there, but they do currently yield just under 5% since the recent doubling (actually 92% if you want to fact-check it) of their dividend. VAALCO has committed to putting cash back into their shareholders’ hands and I, for one, am on board with it.

CONS

Cyclicality. Just as I noted in my last article where I highlighted Friedman Industries, Inc. (see it here) VAALCO deals with the ups and downs of the energy industry cycles. While this isn’t necessarily a massive con, the bumpy ride is one that many investors, and many hedge funds, don’t want to stay on for very long. If you are aware of this then you can find opportunities when others leave it in the dust, but if you are looking for a sleep-well-at-night type stock then be prepared to move on.

The TransGlobe Combination. Okay, okay, before those familiar with this company start a riot and come after me placing this in the cons section hear me out. The diversification gained by the combination is excellent. It really is. But the part that scares me a bit as an investor is that the companies being combined while being in the same industry, are vastly different in terms of what they are accomplishing. One, VAALCO, is primarily an offshore company while TransGlobe deals mainly with on-shore assets. This is a combination that could work extremely well, but only if the company disperses its leadership accordingly. While the TransGlobe assets are much more predictable than the offshore currently in the VAALCO portfolio, the question will be how much of the expected synergies (currently listed at $30-$50M through 2030) are already priced in. While many will see this as a very picky criticism, it is a real one that many companies deal with when working with an acquisition or merger.

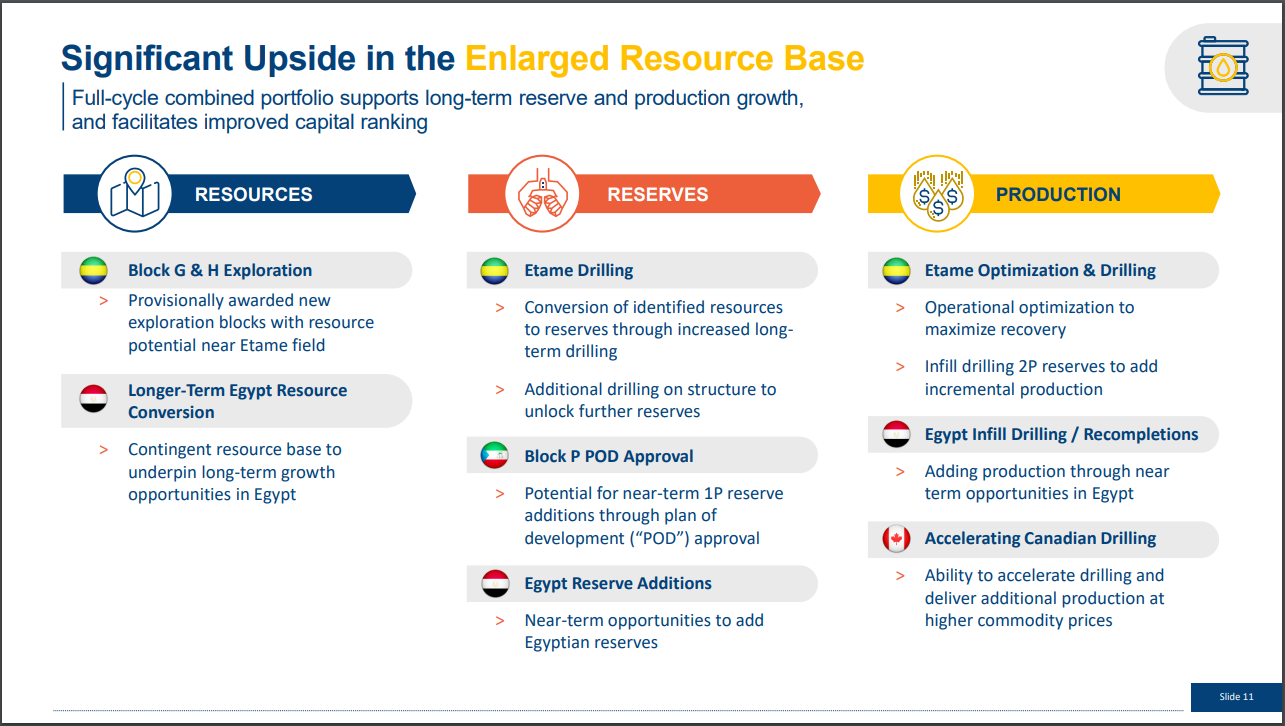

Cap-Ex Intensive Plans. I don’t want to beat the proverbial dead horse here, but the merger is not only a leadership-based risk with decision-making but also is a major risk when it comes to managing the capital expenditures of the entirety of the company. With new areas and projects being added from TransGlobe, every decision must be under a microscope as to where money should be distributed. Whether it be in Canada, Egypt, or the old stomping ground that VAALCO knows well, the decisions will be more amplified. Below is a small list of the opportunities available with the new company, but every opportunity has its cost, and production is never guaranteed.

Conclusion

The Profit Investigator and VAALCO have had a storied past, with the original purchase coming in 2018 when the company traded for under $1 and held almost as much in cash per share. Since that time there have been a lot of changes in VAALCO and it seems that there are even more to come.

The problem with energy has always been the fluctuations in cost and the corresponding balance sheets, but this is where VAALCO shines. With a debt-free balance sheet, dividends, and buybacks stressed tested at $65 and $80 respectively per barrel, the bet for near-term investor returns feels safe as any. Add to all of this the increased diversity of production, the likeliness of cost-saving synergies, and production increases on the horizon, and it appears that we may have a long-term winner as well.

It is for all the reasons above, as well as the confidence in management and future oil prices, that I am rating this company a BUY. I will definitely be adding this to my portfolio in the next few days, and fully expect to let it DRIP and rip for the long term unless something changes. I do see some potential opportunity for downside still in the chart, but with rangebound oil prices, I feel safe to take an immediate half position.

Let me know your thoughts on this one, because I may just be looking at an old friend through rose-colored glasses.

Thanks for reading, and as always, happy investing!

The Profit Investigator